A promising small business once collapsed despite healthy sales and a bustling storefront. The culprit wasn’t poor products or lack of customers—it was a single missed payroll. Revenue was flowing in, customers were buying, but the timing of cash didn’t align with the rhythm of obligations. This scenario plays out more often than most entrepreneurs realise, and it’s entirely preventable with the right financial fundamentals.

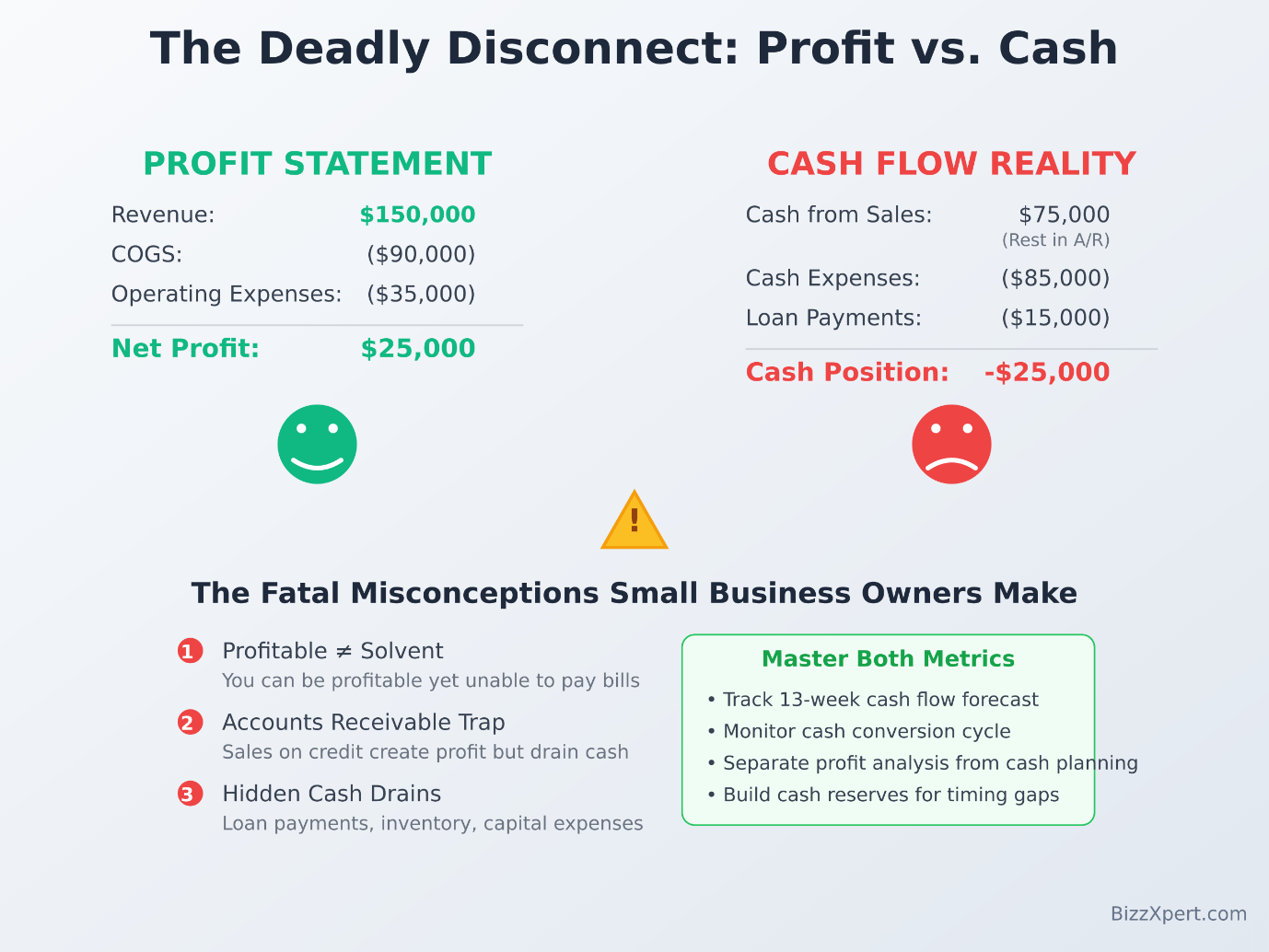

The Deadly Disconnect Between Profit and Cash

Many business owners operate under a dangerous misconception: if the income statement shows profit, the business is safe. This thinking has sunk countless ventures. The reality is that a company can be profitable on paper and bankrupt in practice if cash flow isn’t managed properly.

Consider Jane’s Home Goods, a seasonal retail store that showed monthly profits in her accountant’s reports for 11 months of the year. Yet Jane found herself in crisis when a large supplier invoice arrived before her expected holiday sales spike. Her income statement told one story, but her bank account told another.

The Three Essential Financial Statements

Think of these three documents as different lenses for viewing the same business:

The Income Statement (P&L) tells the story of revenue and expenses over a period. It reveals whether your pricing and cost structure actually produce sustainable results, but it doesn’t tell you when cash arrived or left your accounts.

The Cash Flow Statement reconciles profit with actual money movements, tracking operating activities (receipts from sales, payments to suppliers), investing activities (equipment purchases), and financing activities (loans or owner contributions).

The Balance Sheet provides a snapshot of what you own and what you owe at a specific moment—your assets, liabilities, and equity.

These three statements are distinct but inseparable for sound decision-making. Treating them as mere accounting artefacts instead of decision tools is where many small business owners go wrong.

The 13-Week Cash Forecast: Your Early Warning System

The most practical tool for avoiding cash crises is a rolling 13-week cash forecast. This isn’t complex financial modelling—it’s a simple projection updated weekly with actual results.

Here’s how to build one:

-

- Start with your current cash position

- Project incoming receipts by week (be conservative)

- List outgoing payments by week (include payroll, rent, suppliers)

- Calculate your ending cash position weekly

- Update with actuals and extend the forecast each week

Weekly updates work best for businesses with volatile receipts; monthly forecasting suits steadier operations. The key habit is frequent updating and disciplined comparison of the forecast to reality.

Ready to implement your own 13-week cash forecast?

I’ve created a ready-to-use 13-Week Cash Flow Calculator that does the heavy lifting for you. This tool includes:

-

- Pre-built formulas for automatic calculations

- Weekly cash position tracking with visual indicators

- Customizable categories for your specific business

- Simple instructions to get started in minutes

- Color-coded alerts when cash runs low

Click on the Link 13-Week Cash Flow Calculator to Access the Tool

Practical Cash Management Strategies

When Jane’s Home Goods faced her cash crunch, she had several options that required discipline, not rocket science:

Map payment timing: Convert invoices and receipts into a cash calendar showing expected receipts and required payments by day or week.

Establish a cash buffer: Set a minimum cash balance rule—enough to cover four weeks of payroll and essential suppliers.

Negotiate payment terms: Ask suppliers for net-45 instead of net-30 when seasonal timing creates pressure.

Accelerate receivables: Offer small discounts for early payment or use promotions to smooth sales timing.

Budgeting vs. Forecasting: Know the Difference

These terms are often confused, but they serve different purposes:

Budgets are commitments—plans for spending and revenue allocation that serve as control mechanisms to measure performance against.

Forecasts are expectations—updated estimates of what will actually happen, used as learning tools to recalibrate.

A café might budget labour costs at 25% of sales. If a promotion increases sales but doesn’t proportionally reduce labour costs, the budget reveals the variance. Weekly forecasts allow the owner to adjust staff schedules before the problem compounds.

Essential Financial Ratios: Your Business Vital Signs

Four key ratios provide quick health checks without overwhelming complexity:

-

- Gross Margin = (Revenue – Cost of Goods Sold) / Revenue. Shows pricing efficiency and available funds for operating costs

- Net Profit Margin = Net Income / Revenue. Reveals overall profitability after all expenses

- Current Ratio = Current Assets / Current Liabilities. Indicates short-term liquidity to meet obligations

- Inventory Turnover = Cost of Goods Sold / Average Inventory. Measures inventory efficiency and potential cash tie-up

The Working Capital Challenge

Custom furniture maker or any business with long production cycles faces a particular challenge: revenue is recognised at delivery, but expenses are paid throughout production. Without interim financing or staged invoicing, cash shortfalls are inevitable.

Solutions include:

-

- Staged invoicing tied to project milestones

- Supplier financing arrangements

- Short-term lines of credit

- Careful monitoring of work-in-progress

This is working capital management—the art of timing receipts against payments.

Common Misconceptions That Kill Businesses

Obsessing over top-line growth while ignoring unit economics. Growth that destroys margins isn’t growth—it’s a path to collapse. Always track contribution margin per sale, customer acquisition cost, and payback period.

Treating forecasts as predictions rather than conditional expectations. Document your assumptions explicitly. If you’re assuming 5% sales growth due to a new product line, state it clearly. This discipline forces you to test assumptions rather than hoping they’re correct.

Your Next Steps

Start with these immediate actions:

-

- Create a 13-week cash forecast this week—even a simple spreadsheet beats no forecast

- Calculate your four key ratios monthly — establish your baseline

- Set a minimum cash balance rule — typically 4-6 weeks of fixed expenses

- Review and update your forecast weekly — make it a non-negotiable habit

Financial management isn’t about perfect predictions or complex models. It’s about creating systems that reveal problems early enough to fix them. The businesses that master these fundamentals don’t just survive—they position themselves to seize opportunities when competitors are scrambling to make payroll.

Remember: cash flow problems are almost always predictable and preventable. The question isn’t whether you can afford to implement these practices—it’s whether you can afford not to.

Take the first step: Use my free “13-Week Cash Flow Calculator” and gain visibility into your cash position within the next 30 minutes.

This article is part of a three-part series on Business Fundamentals. Next week, we’ll explore strategic planning and entrepreneurial thinking that turns good ideas into sustainable ventures.